Stop Watching the Fed: Why Real Estate Investors Should Focus on the 10-Year Treasury Instead

Kurt Haneke’s insight from this week’s mastermind reveals what really drives mortgage rates—and it’s not what you think

At this week’s Colorado RE•CON Mastermind, the conversation turned to interest rates—as it often does these days. With the Federal Reserve making headlines about rate cuts due to a weakening job market, many investors are watching every Fed announcement hoping for relief on their borrowing costs.

But then Kurt Haneke made a comment that stopped everyone in their tracks: “The short-term play on interest rates isn’t as telling or impactful as the 10-year bond rate.” Kurt is a real estate broker and seasoned investor who has been a subscriber of Colorado RE•CON (formerly ICOR) for 5+ years. He’s often providing more sage and steady advice around the market.

If you’ve been obsessively checking Fed announcements, as many of us do when a flashy headline appears, expecting your mortgage rates to drop accordingly, Kurt’s insight might save you a lot of wasted time and recalibrate where you focus your market intelligence efforts.

The Disconnect Most Investors Don’t Understand

Here’s what trips up most real estate investors: The Federal Reserve controls the federal funds rate—essentially the overnight lending rate between banks. This directly impacts:

- Savings account rates

- Credit card rates

- Short-term business loans

- HELOCs (which are variable rate)

But here’s what it doesn’t directly control: your 30-year mortgage rate.

“Wait, what?” you might be asking. “I keep seeing headlines about the Fed cutting rates to make borrowing cheaper!”

Yes, the Fed cuts rates to make borrowing cheaper—for short-term lending. But your 30-year fixed mortgage? That follows a completely different benchmark.

The Real Driver: The 10-Year Treasury Yield

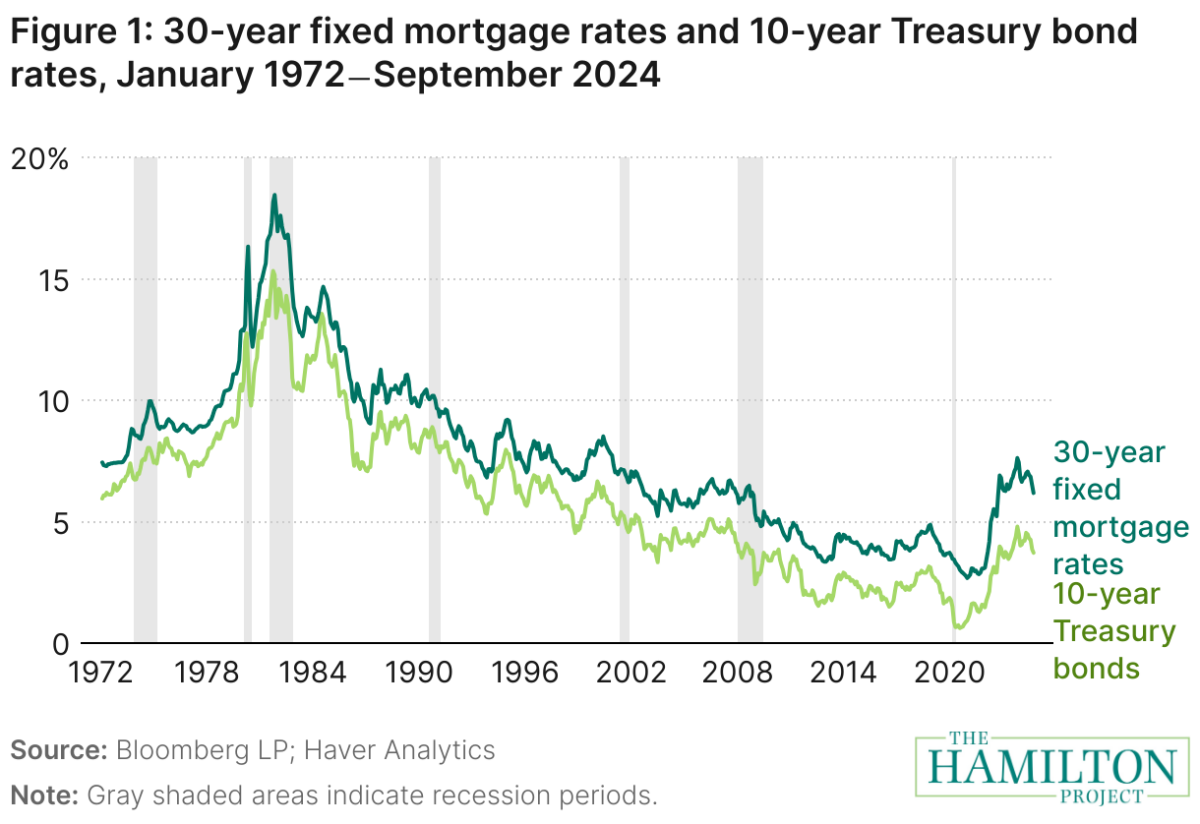

Look at the chart from The Hamilton Project spanning 1972 to 2023. Notice anything? The 30-year mortgage rate (dark green line) shadows the 10-year Treasury bond rate (light green line) almost perfectly. They move together. They rise together. They fall together.

This isn’t coincidence—it’s by design.

Why Mortgages Follow the 10-Year Treasury

Think about it from the lender’s perspective. When you get a 30-year mortgage, that lender is tying up their capital for potentially three decades (even though most homeowners refinance or sell within 10 years, which is why the 10-year Treasury is the benchmark rather than a 30-year).

The 10-year Treasury yield represents the government’s borrowing cost for a decade—the “risk-free” rate of return. If a lender can get 4.10% essentially risk-free by buying Treasury bonds, why would they lend you money for a mortgage at 4.10%? They won’t. They need to earn more than the risk-free rate to compensate for the risk that you might default, refinance early, or prepay.

This extra amount is called the “mortgage spread,” and it typically ranges from 0.71 to 1.4 percentage points above the 10-year Treasury yield. So if the 10-year Treasury is at 4.10%, you can expect mortgage rates to be somewhere around 4.81% to 5.50%—which aligns pretty closely with current rates.

What Actually Moves the 10-Year Treasury?

This is where it gets interesting for investors. The 10-year Treasury yield is driven by three main factors:

- Investor Expectations on Future Monetary Policy

Yes, the Fed plays a role here—but it’s indirect. When the Fed signals its long-term intentions, investors adjust their expectations and either buy or sell Treasury bonds accordingly. But it’s investor behavior, not Fed policy directly, that moves the needle. - Economic Growth Outlook

When the economy is strong, investors chase higher returns in stocks and corporate bonds, driving money away from “safe” Treasuries. This causes Treasury prices to fall and yields to rise—which means mortgage rates go up even as the economy improves.

Conversely, when there’s economic uncertainty (like now, with new tariffs and slower job growth), investors flee to the safety of Treasury bonds. High demand for Treasuries pushes prices up and yields down—which means mortgage rates can drop even if the Fed hasn’t cut rates. - Inflation Expectations

This is the big one. If investors expect inflation to erode the value of their returns over 10 years, they demand higher yields to compensate. Higher yields = higher mortgage rates.

This is why we can have situations where the Fed is cutting short-term rates (because they’re worried about economic growth) while mortgage rates are actually rising (because investors are worried about inflation). The two can move in opposite directions.

The Recent Disconnect: A Real-World Example

In late 2023 and early 2024, we saw exactly this disconnect play out. The Fed held rates steady and even hinted at cuts, yet mortgage rates climbed. Why? Because the 10-year Treasury yield was rising as investors worried about persistent inflation and strong economic data that suggested the Fed wouldn’t be able to cut rates as aggressively as previously expected.

Investors who were waiting for Fed rate cuts to refinance their properties were frustrated—but investors who were watching the 10-year Treasury saw it coming.

What This Means for Your Real Estate Strategy

As real estate investors, here’s how you should adjust your thinking:

STOP: Reacting to every Fed announcement as if it directly impacts your mortgage rates

START: Tracking the 10-year Treasury yield as your primary interest rate indicator

STOP: Waiting for “the Fed to cut rates” before refinancing or acquiring properties

START: Watching for the 10-year Treasury to trend downward—that’s your signal

STOP: Assuming low Fed rates automatically mean cheap mortgages

START: Understanding that economic uncertainty (which often accompanies Fed cuts) can actually drive Treasury yields and mortgage rates down more effectively than Fed policy alone

Practical Application: Where to Watch

You don’t need to be an economist to track this. Here’s what you can do:

- Bookmark a 10-year Treasury yield tracker (CNBC, Bloomberg, or even Google Finance show it in real-time)

- Check it weekly, not daily—you’re looking for trends, not day-to-day volatility

- When you see the 10-year Treasury yield dropping and staying down for 2-3 weeks, that’s when you start calling lenders for refinance quotes or getting pre-approved for acquisitions

- Watch the spread—if mortgage rates aren’t following the 10-year Treasury down, that means lenders are widening their spread (often due to market uncertainty or liquidity concerns), which tells you something about market conditions

The bottom line

Kurt Haneke’s comment at the mastermind this week wasn’t just a throwaway observation—it was a masterclass in understanding what actually drives the costs that matter most to real estate investors.

The Fed makes headlines, but the 10-year Treasury makes your deals pencil.

The next time you hear “The Fed cut rates by 25 basis points,” don’t immediately assume your borrowing costs just got cheaper. Instead, pull up the 10-year Treasury yield and see what it’s doing. That’s the number that will actually impact your mortgage rate when you go to refinance that rental property or acquire your next deal.

As we head into 2026 with continued economic uncertainty, tariff discussions, and ongoing inflation concerns, this distinction between Fed rates and Treasury yields matters more than ever. Smart investors won’t be watching the Fed—they’ll be watching the bond market.

And thanks to Kurt’s insight, now you know why.

Sources:

- Kiplinger: “How Does the 10-Year Treasury Yield Affect Mortgage Rates?”

- The Hamilton Project: 30-year fixed mortgage rates and 10-year Treasury bond rates, January 1972–October 2023

- Fannie Mae: Historical mortgage spread data

- Colorado RE•CON Mastermind discussion

About the Author: Troy Miller is CCO of Colorado RE•CON (formerly ICOR – Investment Community of the Rockies), helping real estate investors navigate market dynamics for over 18 years. Special thanks to Kurt Haneke for the insight that sparked this article.

Disclaimer: This article is for educational purposes and should not be considered financial advice. Always consult with qualified professionals before making investment decisions.