"The short-term play on interest rates isn't as telling or impactful as the 10-year bond rate."

Kurt Haneke

Real estate broker and seasoned investor

Colorado RE•CON subscriber

If you've been obsessively checking Fed announcements, as many of us do when a flashy headline appears, expecting your mortgage rates to drop accordingly, Kurt's insight might save you a lot of wasted time and recalibrate where you focus your market intelligence efforts.

Market Trends

February 9, 2026

U.S. Homeownership & Rental Vacancy Rates for Q4 2025

The U.S. government is reporting that the national vacancy rates for Q4 2025 were 7.2% for rental housing and 1.2% for homeowner housing. The national homeownership rate for Q4 2025 was 65.7%. In addition, approximately 89.9% of the housing units in the United States in Q4 were occupied and 10.1% were vacant. Owner-occupied housing units made up 59% of total housing units, while renter-occupied units made up 30.8% of the inventory. Vacant year-round units comprised 7.8% of total housing units, while 2.3% were vacant for seasonal use.

Market Trends

February 5, 2026

Zillow’s Hottest Markets for 2026

According to Zillow’s 2026 housing market forecast, Hartford, Connecticut is the hottest U.S. market, dethroning Buffalo, New York after two years at number one. In Hartford, home prices grew faster than in any other major metro in 2025 and are expected to continue rising in 2026, albeit slightly more slowly. Buffalo ranks second, with strong competition and seller advantages, while the New York metro area is third. Other top-ranked markets include Providence and San Jose.

Market Trends

February 2, 2026

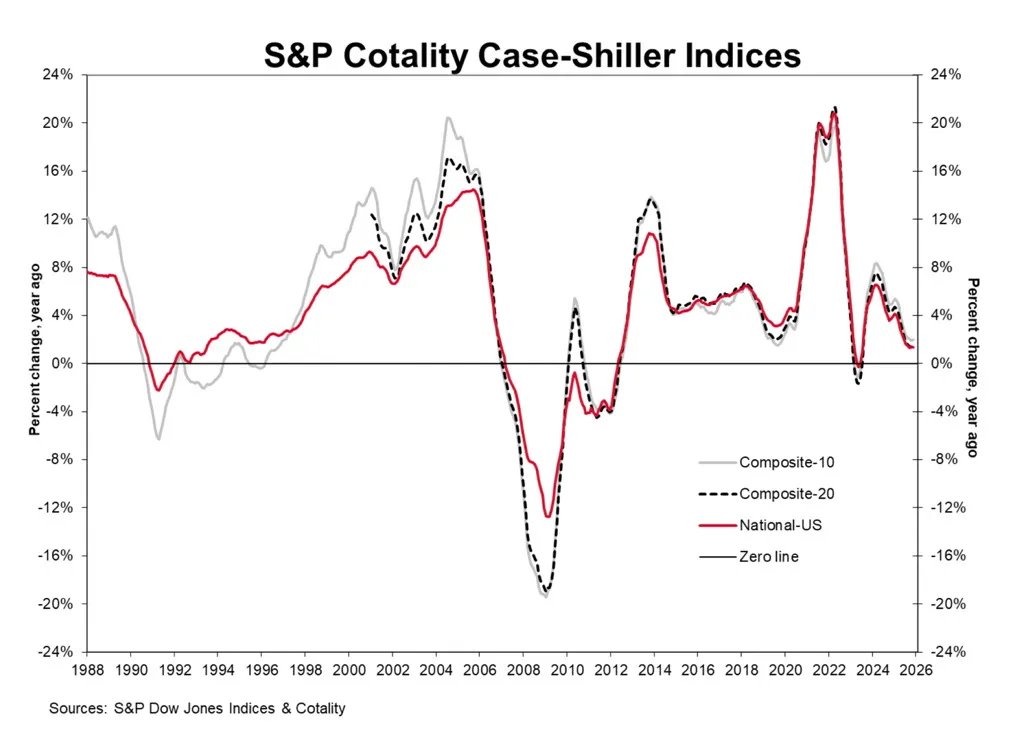

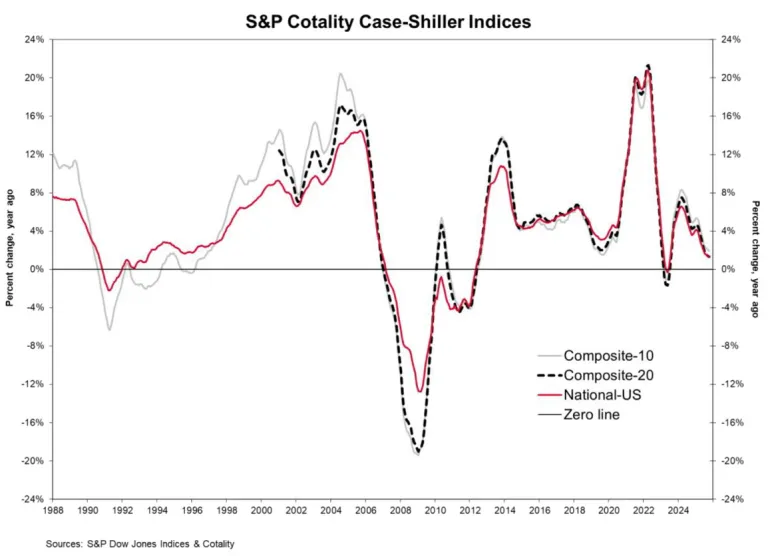

S&P Cotality Case-Shiller Says Housing Market Entered a Period of Tepid Growth

The latest S&P Cotality Case-Shiller U.S. National Home Price NSA Index has reported a 1.4% annual increase for November, 2025. Their 10-City Composite posted 2% increase year-over-year and their 20-City Composite posted a 1.4% year-over-year increase. They say the housing market has entered a period of tepid growth.

Market Trends

February 2, 2026

Tenant Unions are on the Rise

As you may know, there is a growing (and troubling) “tenants union” movement across the nation. A recent news story from Cincinnati’s WCPO (TV ch 9) talks with organizers and renters who are among a group that recently joined the Cincinnati Tenants Union to negotiate a new lease with their landlord. WCPO says their 25-page proposal calls for a 12-month rent freeze for existing tenants and prohibits pet fees and security deposits. In addition, it adopts “just-cause eviction standards” that are common in other cities but are new in Cincinnati.

Market Trends

January 29, 2026

Local Market Monitor’s National Economic Outlook for January ’26

Local Market Monitor recently released their monthly National Economic Outlook where they share their thoughts on developments taking place in the U.S. economy.

Market Trends

January 26, 2026

Pending Home Sales Drop 9.3% in December

The National Association of Realtors is reporting that pending home sales dropped 9.3% in December, 2025 and were down 3% year over year. The NAR’s Pending Home Sales Index (a forward-looking indicator based on contract signings) came in at 71.8 in December.

Market Trends

January 22, 2026

National Single Family Inventory Snapshot

A recent Daily-Download chart from HousingWire shows us a snapshot of the national single family inventory. Notice the current 2026 line on the top left side.

Market Trends

January 21, 2026

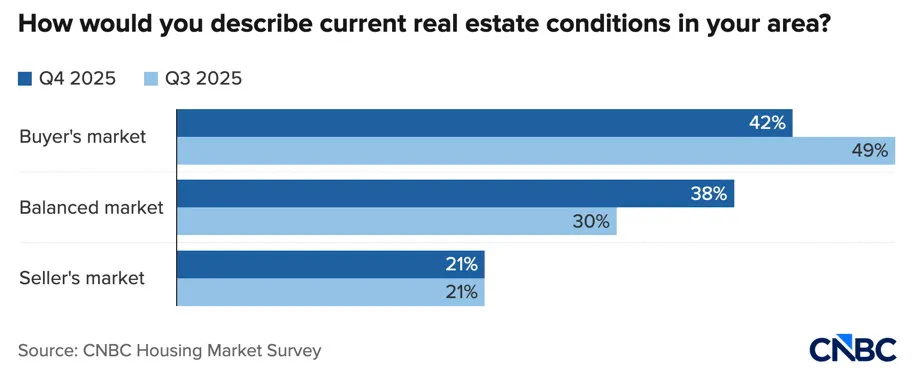

Real Estate Agents Say Housing Market is Balancing Out

A recent report by CNBC’s Diana Olick says while the U.S. housing market has yet to pick up steam, real estate agents say there’s been a real shift toward a more balanced market. The data comes from CNBC’s Q4 2025 Quarterly Housing Market Survey.

Market Trends

January 19, 2026

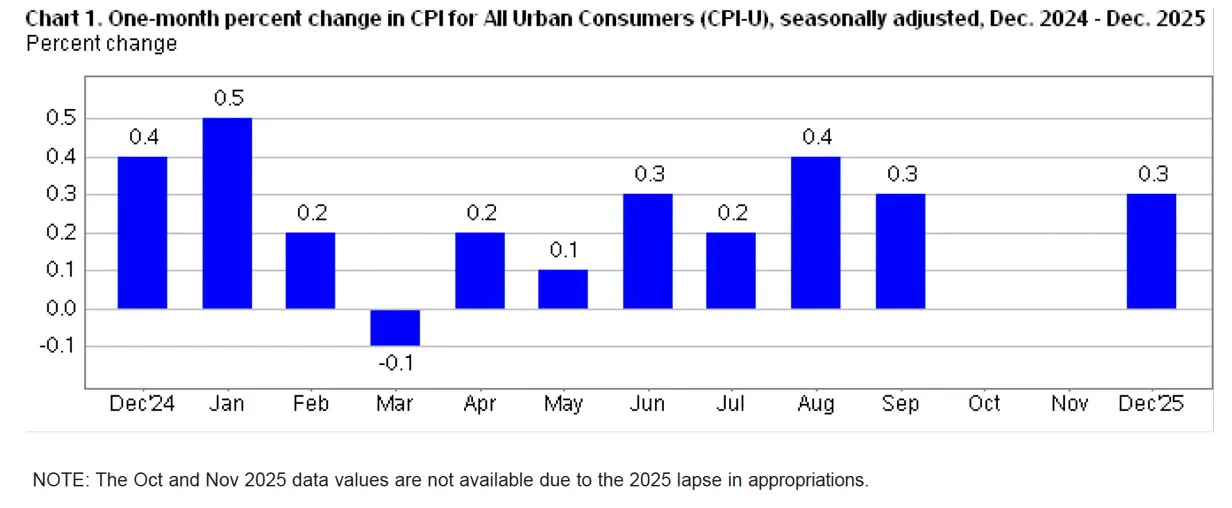

Inflation Remains at 2.7%

The U.S. Bureau of Labor Statistics is reporting that the Consumer Price Index for All Urban Consumers (CPI-U) was up 0.3% on a seasonally adjusted basis in December 2025. Over the last 12 months, the all items index increased 2.7% before seasonal adjustment. The index for shelter rose 0.4% in December and was the largest factor in the all items monthly increase. The food index increased 0.7% over the month as did the food at home index and the food away from home index. The index for energy rose 0.3% in December.

Market Trends

January 16, 2026

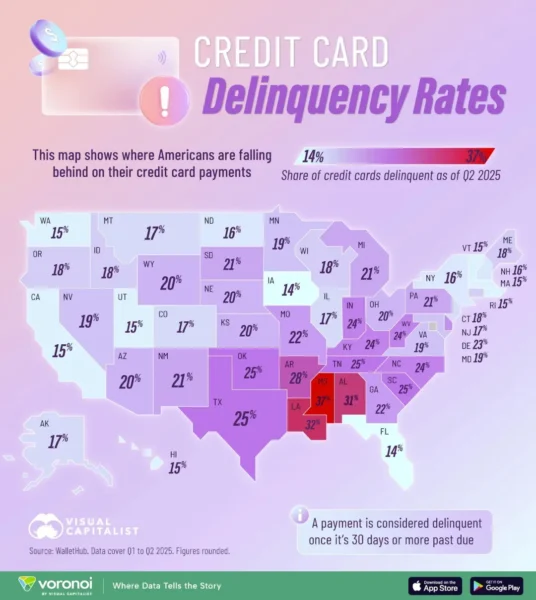

Credit Card Delinquency Rates by State

Earlier this week we shared an eye-opening post about those cities with the least sustainable credit card debt. Today’s infographic from those wizards at the Visual Capitalist shows those states where Americans are falling behind on their credit card payments.

Market Trends

January 13, 2026

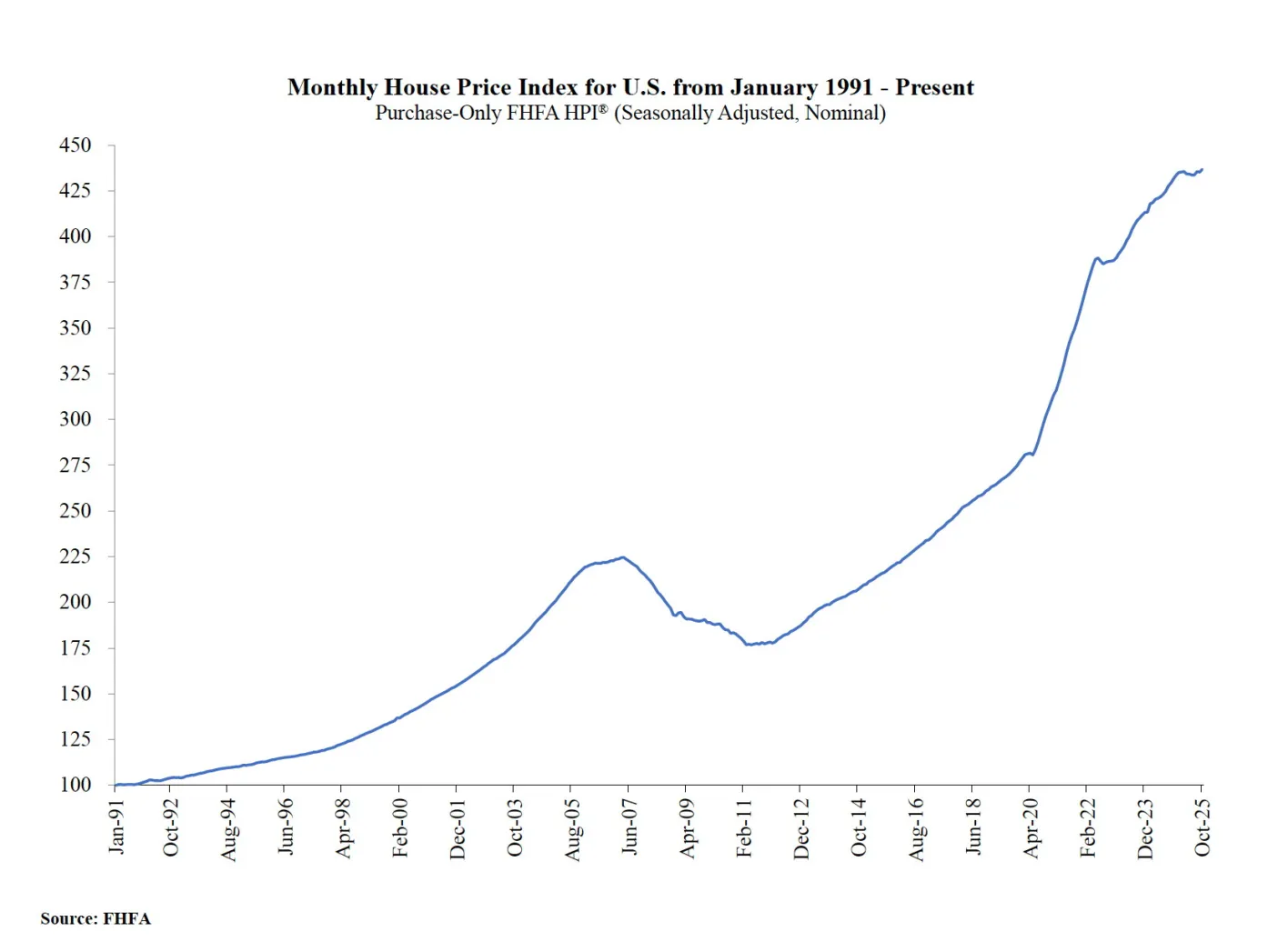

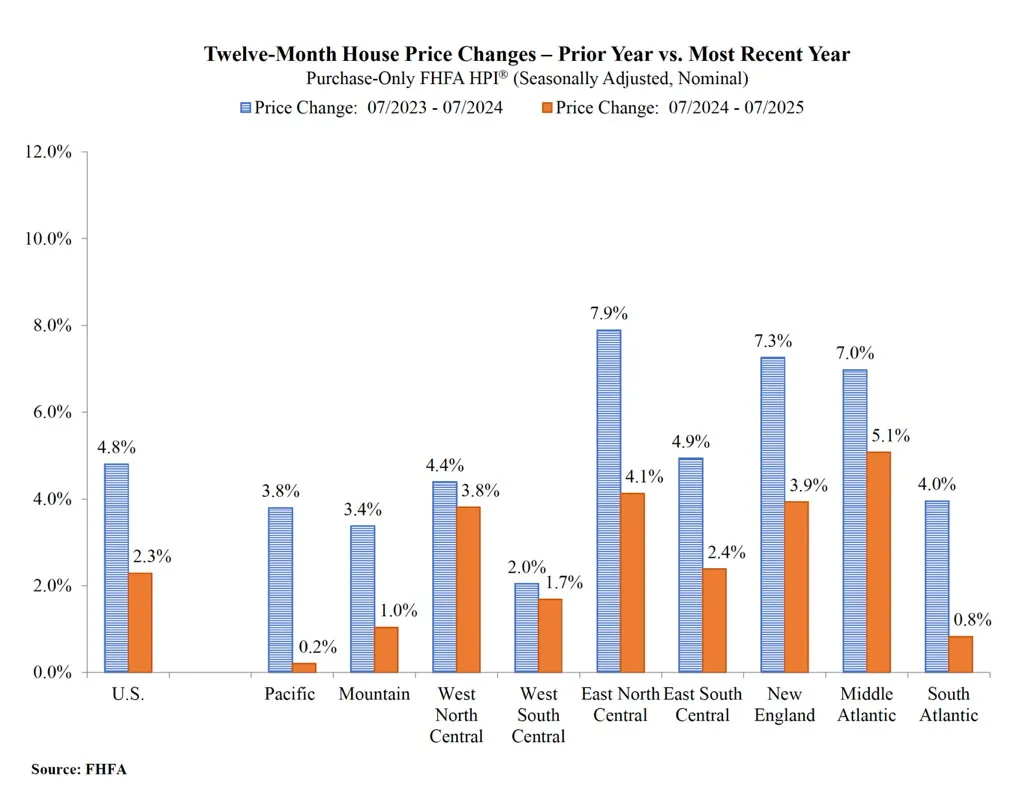

FHFA Says Home Prices Up 1.7% Year-Over-Year

According to the latest Federal Housing Finance Agency’s (FHFA) House Price Index (HPI), home prices rose 0.4% in October, 2025. In addition, prices were up 1.7% from October 2024 to October 2025. The FHFA HPI is the nation’s only collection of public, freely available house price indexes that measure changes in single-family home values based on data from all 50 states and over 400 American cities that extend back to the mid-1970s.

Market Trends

January 13, 2026

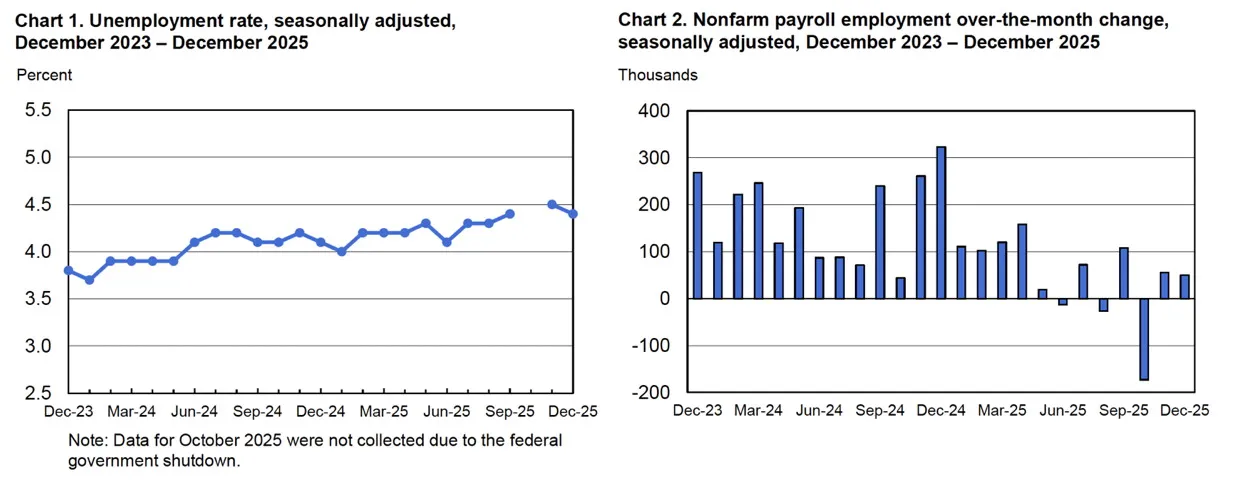

December’s Unemployment Rate is 4.4%

According to the U.S. Department of Labor’s Bureau of Labor Statistics, total nonfarm payroll employment changed little in December, 2025 and has shown little net change since April. December’s unemployment rate came in at 4.4%. In addition, the report says employment continued to trend up in food services and drinking places, health care, and social assistance while retail trade lost jobs.

Market Trends

January 9, 2026

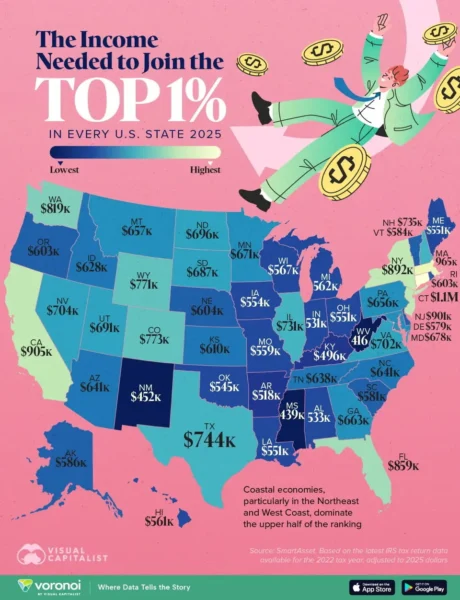

The Income Needed to Join the Top 1% in Every State in 2025

Now that the new year is here it’s time to see what it takes (took?) in income to in the top 1% in every state. Citing data from SmartAsset, the Visual Capitalist looks at the amount of income you need to earn in each state to join this prestigious club.

Market Trends

January 8, 2026

$5B in Questionable Rental Assistance went to Thousands of Deceased Tenants

The NY Post is reporting that a recent HUD audit found more than $5 billion in taxpayer funds went to “questionable” rental assistance recipients during the final year of the Biden administration – including around 30k deceased tenants and 1000’s of potential non-citizens. The Post says HUD will now reach out to public housing authorities and other entities to confirm the extent of the fraud and either pause or revoke funding. In addition, criminal referrals could be made if warranted.

Market Trends

January 6, 2026

S&P Cotality Case-Shiller Says Housing Market Settling into Much Slower Gear

The latest S&P Cotality Case-Shiller U.S. National Home Price NSA Index has reported a 1.4% annual increase for October, 2025. Their 10-City Composite posted 1.9% increase year-over-year and their 20-City Composite posted a 1.3% year-over-year increase.

Market Trends

January 5, 2026

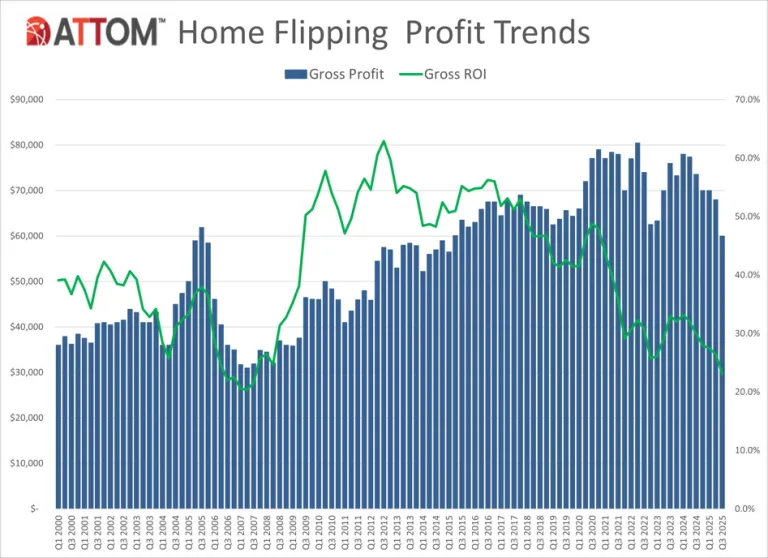

Flipping ROI Drops Below 25% – Lowest Level Since 2008

According to ATTOM data’s latest flipping report, there were 72,217 single-family homes & condominiums flipped Q3 2025, accounting for 6.8% of home sales from July through September. In addition, they found that the typical profit margin for a flipped home in Q3 was 23.1%, down from 26.5% in Q2 and down 29.8% from one year ago.

Market Trends

January 1, 2026

Google is Testing Embedded Home Listings in Certain Cities

A recent article on HousingWire says Google is entering the “portal wars” with posting MLS listings on their search site in certain cities. According to the report, Google is testing embedded home listings in mobile search, which HW says could impact portal stocks and raise industry questions. Currently, embedded listings are being seen in the markets of Denver, Chicago and Austin.

Market Trends

December 29, 2025

Redfin’s Predictions for 2026

We recently saw Zillow’s 10 predictions for 2026, now comes Redfin, who says a “Great Housing Reset” will take shape next year. They add that it won’t be a quick price correction, and it won’t be a recession, but it will mark the beginning of a long, slow recovery for the housing market.

Market Trends

December 25, 2025

Local Market Monitor’s National Economic Outlook for December ’25

“New data suggest that home prices will be lower in many local markets during the next year. Most suggestive is that prices were lower in Florida in the last two quarters. Florida is often a leader in home price trends because of the steady number of homes that come on the market as the large retirement population turns over.”

Market Trends

December 24, 2025

ATTOM’s Top 10 Highest Risk U.S. Housing Markets

Recent analysis from ATTOM Data identifies those county-level housing markets that are more or less vulnerable to declines. In fact, their latest U.S. Housing Risk Report says that 16 of the 50 highest-risk markets were located in California, followed by nine in New Jersey, four in Florida, and three each in Arizona and Texas. Risk levels were assessed using factors such as affordability, the share of seriously underwater mortgages, foreclosure activity, and county unemployment rates.

Market Trends

December 22, 2025

Existing Home Sales Up 0.5% in November

The National Association of Realtors is reporting that existing home sales were up 0.5% in November, 2025 to a seasonally-adjusted annual rate of 4.13 million. Total housing inventory at the end of November was 1.43 million units, down 5.9% from October but up 7.5% from one year ago. Unsold inventory sits at a 4.2-month supply at the current sales rate with properties remaining on the market for around 36 days. The median existing-home price for all housing types in November was $409,200 – the 29th consecutive month of year-over-year price increases.

Market Trends

December 17, 2025

Zillow’s Housing Market Predictions for 2026

Keeping up with posting the various real estate predictions for 2026, today we take a look at Zillow’s. In a nutshell, Zillow says the housing market should settle into a healthier state in 2026, with buyers seeing a bit more breathing room and sellers benefiting from price stability and more consistent demand. They project 4.26 million existing home sales next year and forecast that values will rise 1.2%.

Market Trends

December 12, 2025

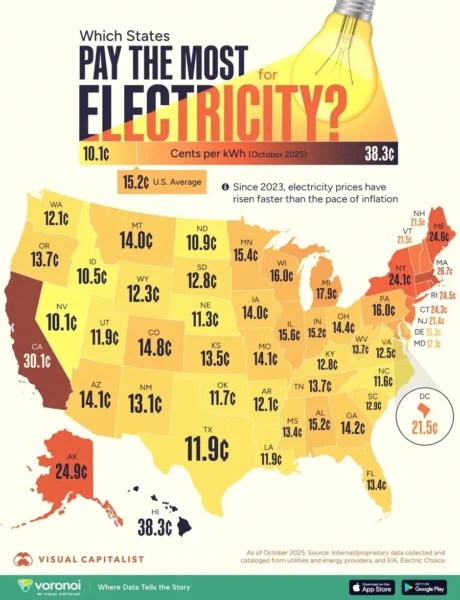

The Average Cost of Electricity by U.S. State

Which states pay the most for electricity? The folks at data visualizer Voronoi remind us that electricity costs vary widely across the country. These variations are from a combination of geography, infrastructure, fuel mix, and policy. Today’s graphic ranks states based on average electricity rates – both residential & commercial.

Market Trends

December 10, 2025

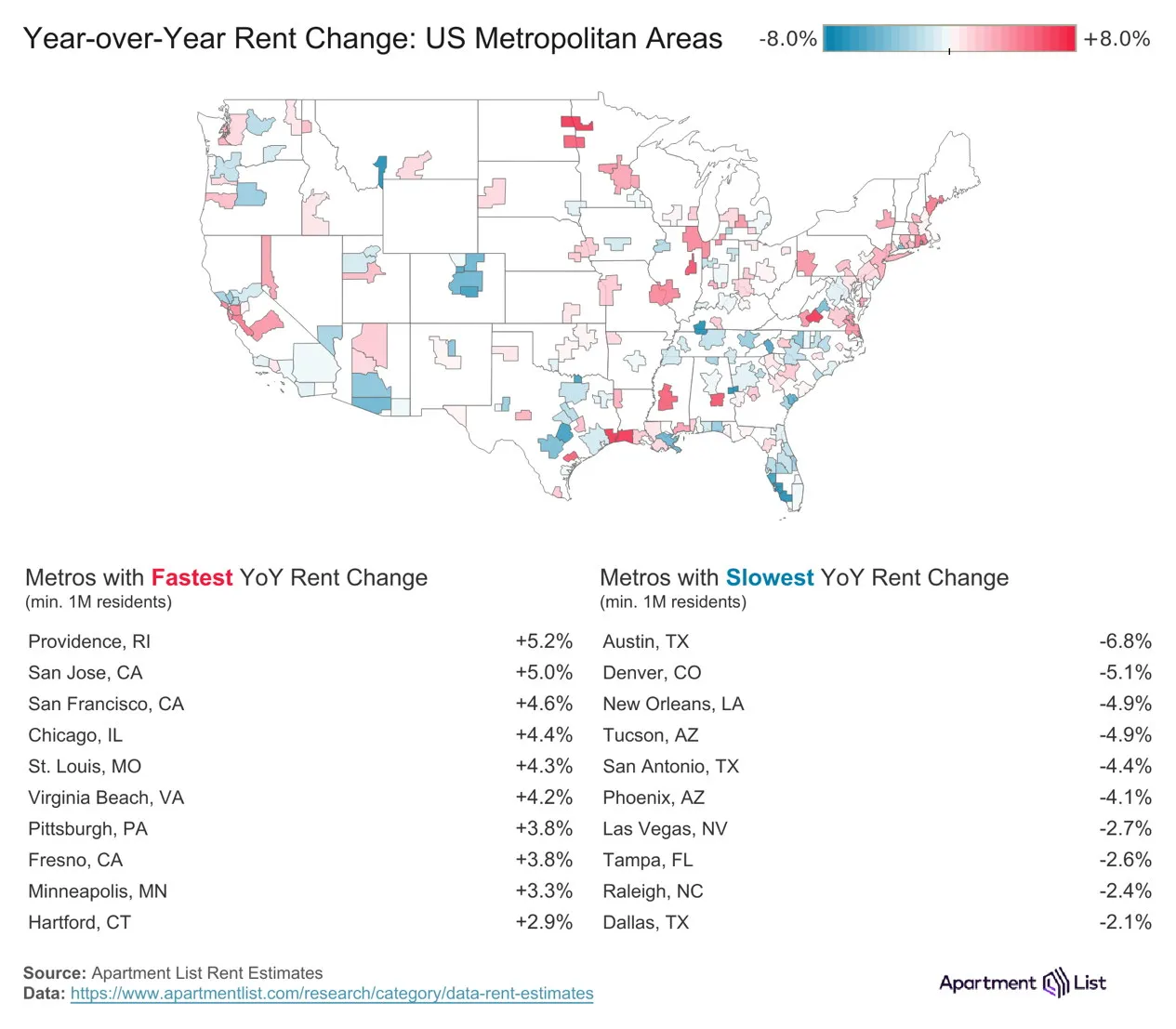

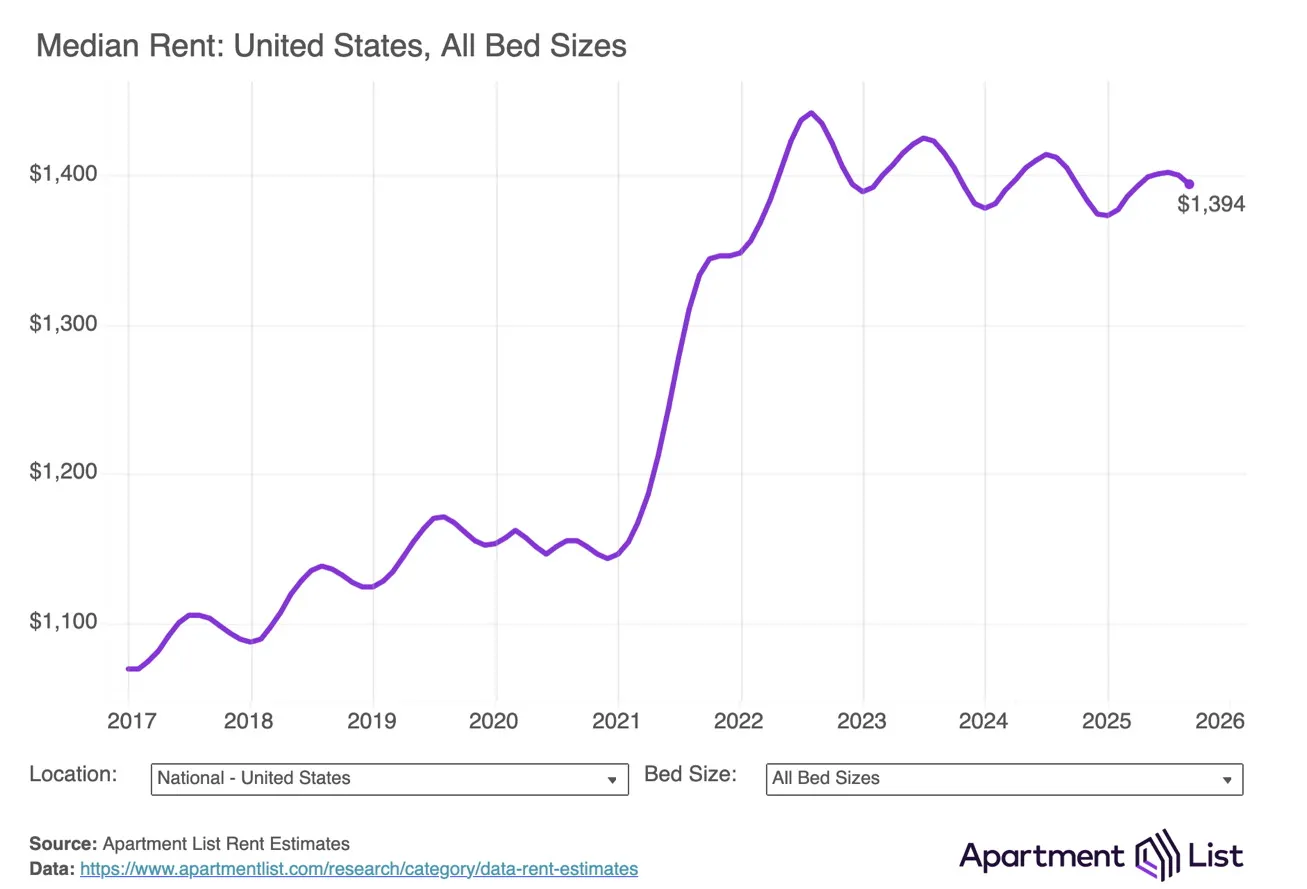

Apartment List’s National Rent Report – December 2025

According to Apartment List’s National Rent Report for December 2025, national median rent dropped 1% in November to $1,367 – the fourth consecutive month-over-month decline. They say all of their key indicators are pointing toward ongoing sluggishness in the multifamily rental market – rent prices are down and the vacancy rate is at an all-time high. In addition, they added that it’s likely 2025 will close out with an additional modest rent decline in December.

Market Trends

December 9, 2025

Building Material Prices Edge Up

Recent analysis from the NAHB’s Eye on Housing says aggregate residential building material prices rose at their fastest pace since January 2023. The data came from the latest Producer Price Index from the Bureau of Labor Statistics. In addition, input energy prices increased for the first time in over a year, while service price growth remained lower than goods.

Market Trends

December 3, 2025

Should You Use a HELOC to Buy an Investment Property?

On a recent episode of the Idaho Real Estate Investor Show, Jonna Weber breaks down exactly when using a HELOC to buy a rental property makes sense, when it doesn’t, and how new investors can safely leverage their home equity to build long-term wealth.

Market Trends

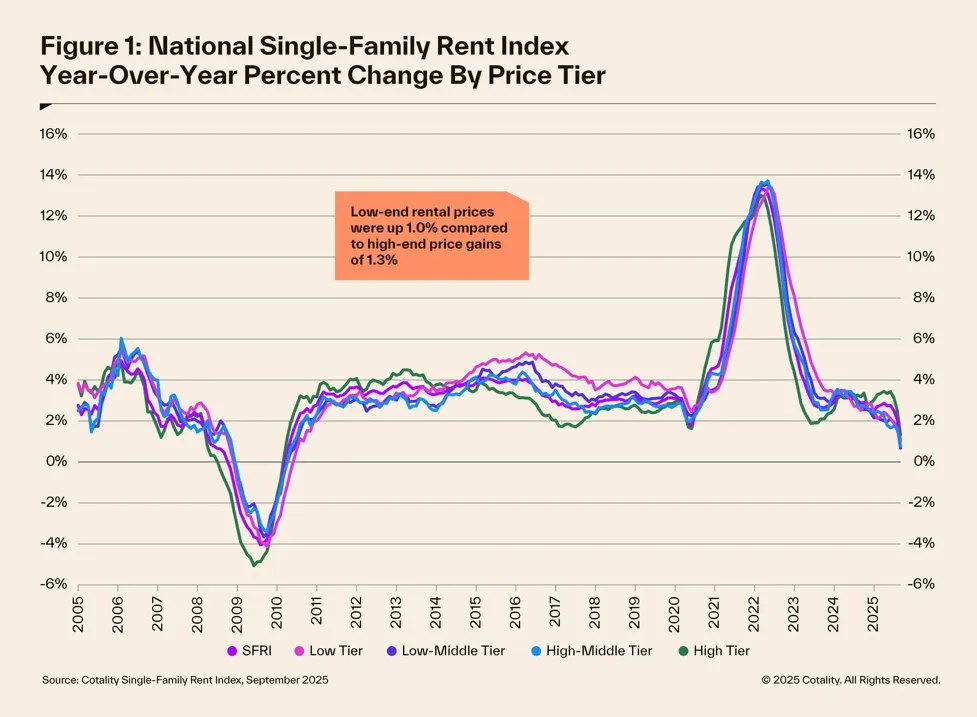

U.S. Single-Family Rent Increase Lowest in 15 Years

According to the latest Cotality (formerly CoreLogic) Single-Family Rent Index (SFRI), U.S. single-family home rental prices increased 1% year over year in September, 2025 – lowest growth rate in 15 years. In addition they report that while growth slowed nationally, rent still has still increased 29% over the last five years, which means renters are paying an average of $610 a month or $7,300 a year in rent.

Market Trends

November 26, 2025

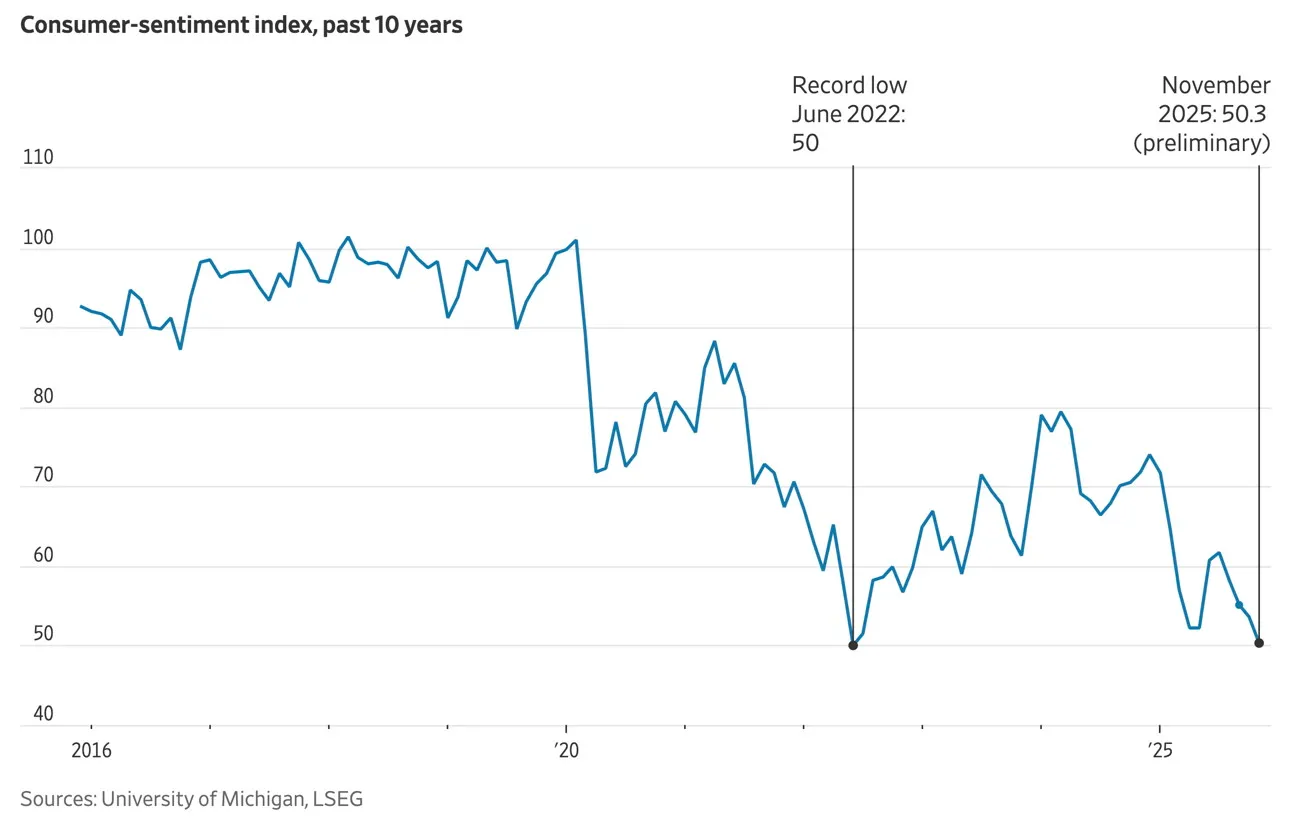

Consumer Sentiment Falls Toward Record-Low Levels

The WSJ is reporting (reposted on Realtor.com) that consumers’ moods dropped further in November, according to a monthly survey from the University of Michigan, continuing a slide that has worsened amid persistent price increases and an extended government shutdown (which ended in mid-November). In addition, they say the survey reading is slightly above levels that sentiment sank to amid historic inflation that hit in 2022.

Market Trends

November 18, 2025

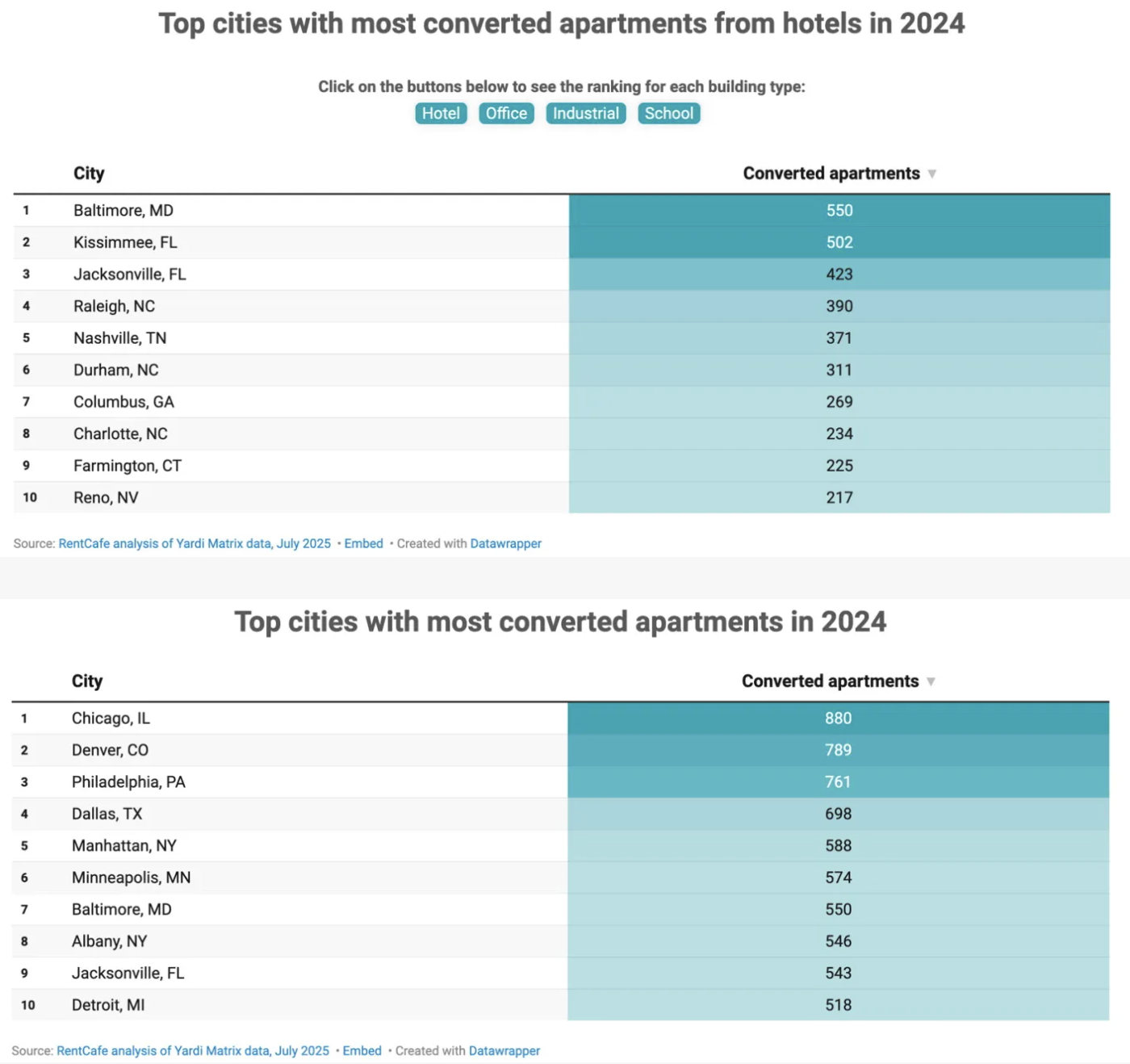

Former Hotels Are Powering America’s Housing Supply

A recent report from RentCafe says the wave of adaptive reuse projects is accelerating at a record pace with Hotels taking the top category for adaptive reuse projects last year. Overall, the number of apartments resulting from converted buildings was close to 25k in 2024. That number is 50% more than the units delivered in 2023 and double from 2022.

Market Trends

November 17, 2025

Yardi Says Rents Reflect Uncertain Economy

According to the latest Yardi Matrix Multifamily Report, multifamily rents posted gains in October, 2025 with the average U.S. advertised rent dropping $4 to $1,743 and year-over-year rent growth came in at 0.5%. Yardi says rents continued to drop in October in the face of weakening demand amid economic uncertainty and deteriorating consumer health.

Market Trends

November 13, 2025

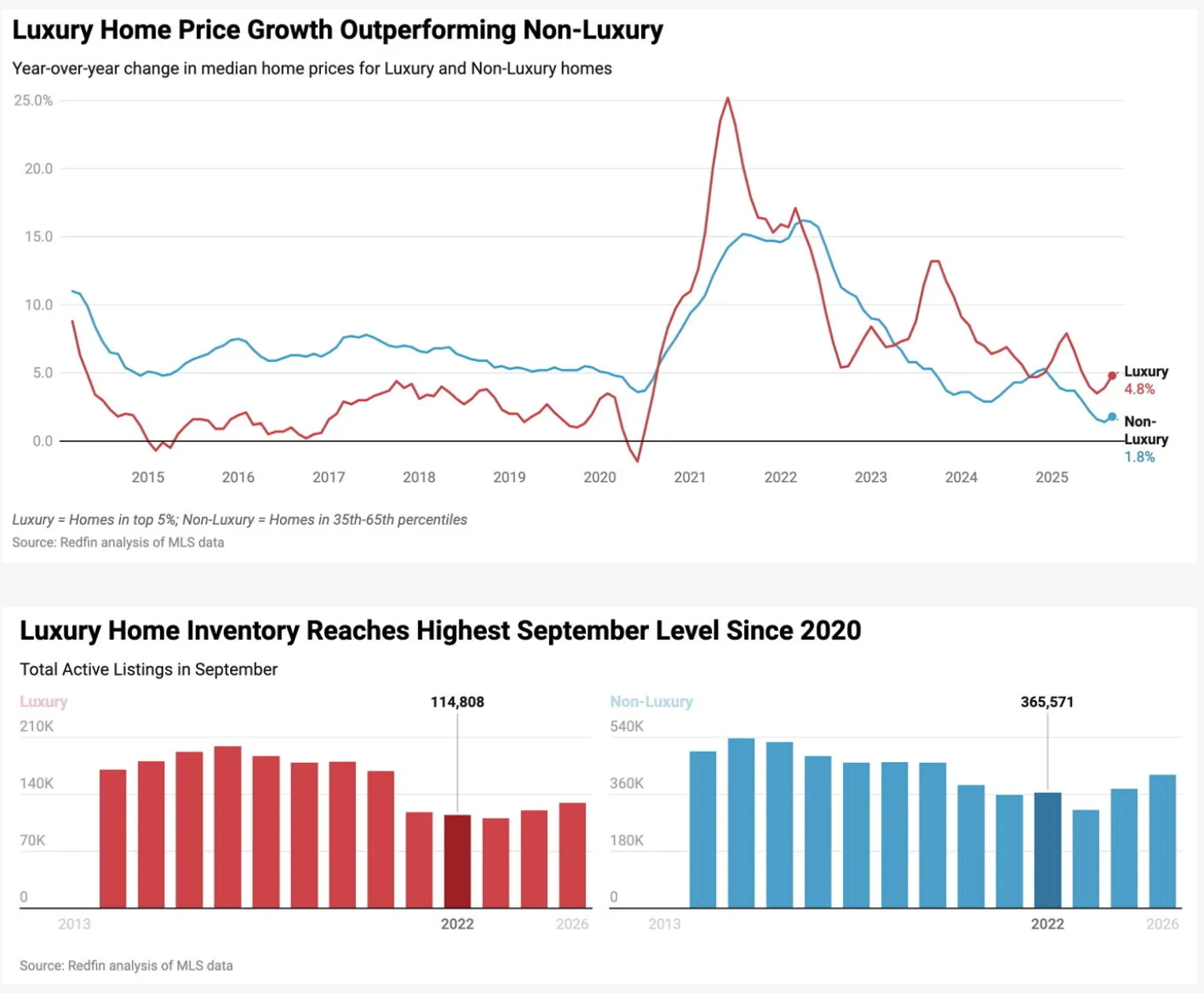

Luxury Home Prices Up 5% in September, Twice the Pace of Non-Luxury

New data from Redfin shows that the typical luxury home sold for $1.26 million in September 2025, up 4.8% from a year earlier and a record high for the month. This rate is just over twice the pace of price growth for non-luxury homes, which rose 1.8% year over year to a median price of $371,583.

Market Trends

November 12, 2025

Pets in Rental Housing: A Growing Opportunity for Property Operators

Today, well over half of U.S. households—between 66% and 75%—own a pet. Let’s break that down in the context of rental housing. With approximately 44.5 million renter-occupied housing units in the country, and assuming 70% of these households have pets, that translates to more than 31 million pet-owning renter households. Among those, the average pet ownership per household is 1.6 dogs or 1.8 cats. Using the more conservative estimate of 1.6 pets per household, we’re looking at nearly 50 million pets living in U.S. rental housing.

Market Trends

November 11, 2025

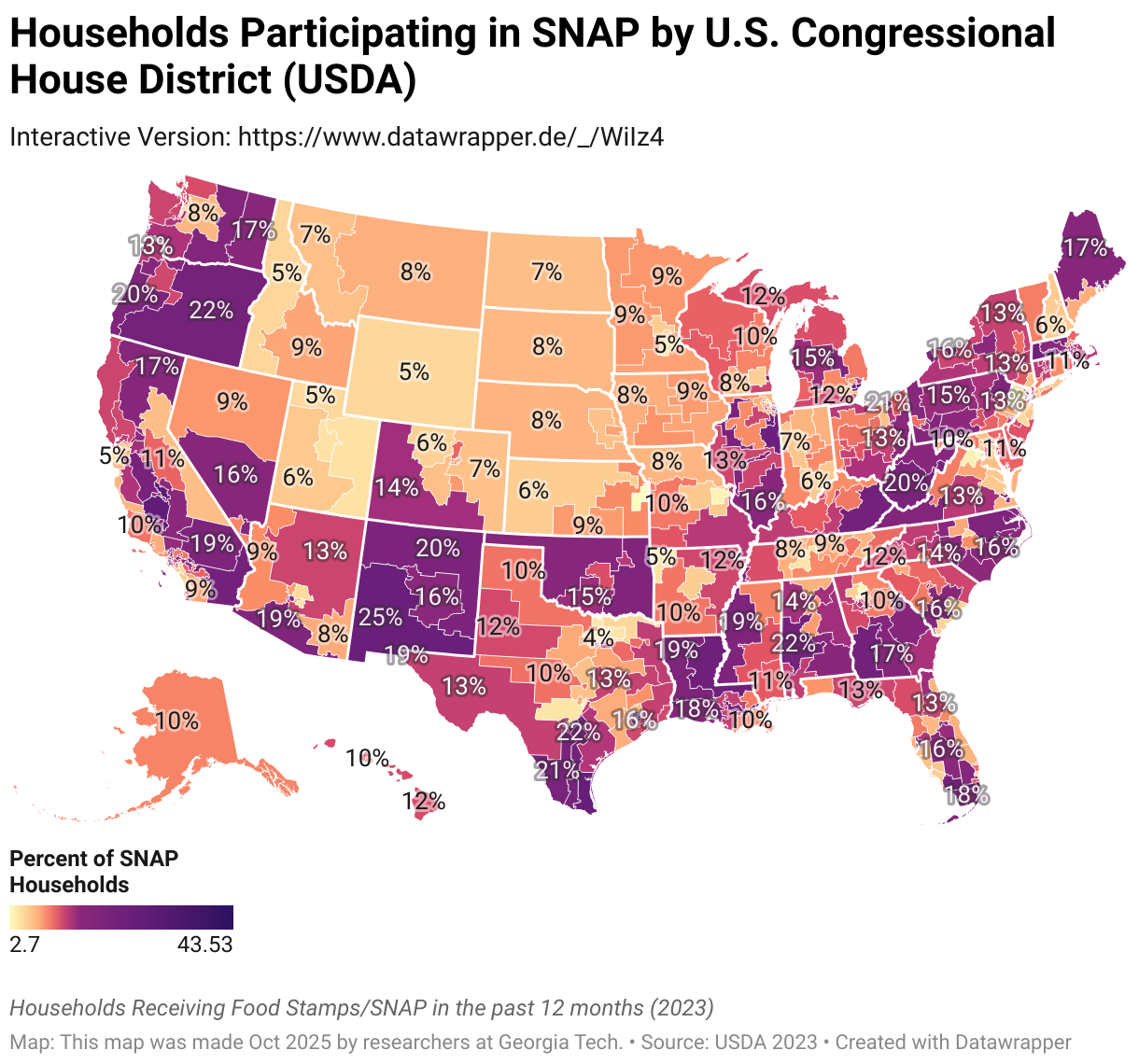

Households Receiving Food Stamps (SNAP) by Congressional District

Last month we featured an infographic with a state by state breakdown of American’s on Welfare. That being said, with all of the recent hullabaloo (and controversy) over funding for SNAP benefits during the government shutdown, the folks at Brilliant Maps put together an interactive map of households by congressional receiving SNAP benefits (aka food stamps). Be sure to look at their complete list of all congressional districts which can be sorted several different ways.

Market Trends

November 6, 2025

Apartment Owners Under Siege

A recent article on the multifamily-industry news site Yield PRO says the assault on rentals marches on – adding to the mounting reasons the supply of the nation’s housing remains behind demand. They say this time, the weapon of choice isn’t new legislation, it’s decades-old consumer protection laws that activists & plaintiff’s attorneys have suddenly discovered can be twisted to destroy standard business practices that have worked for generations.

Market Trends

November 5, 2025

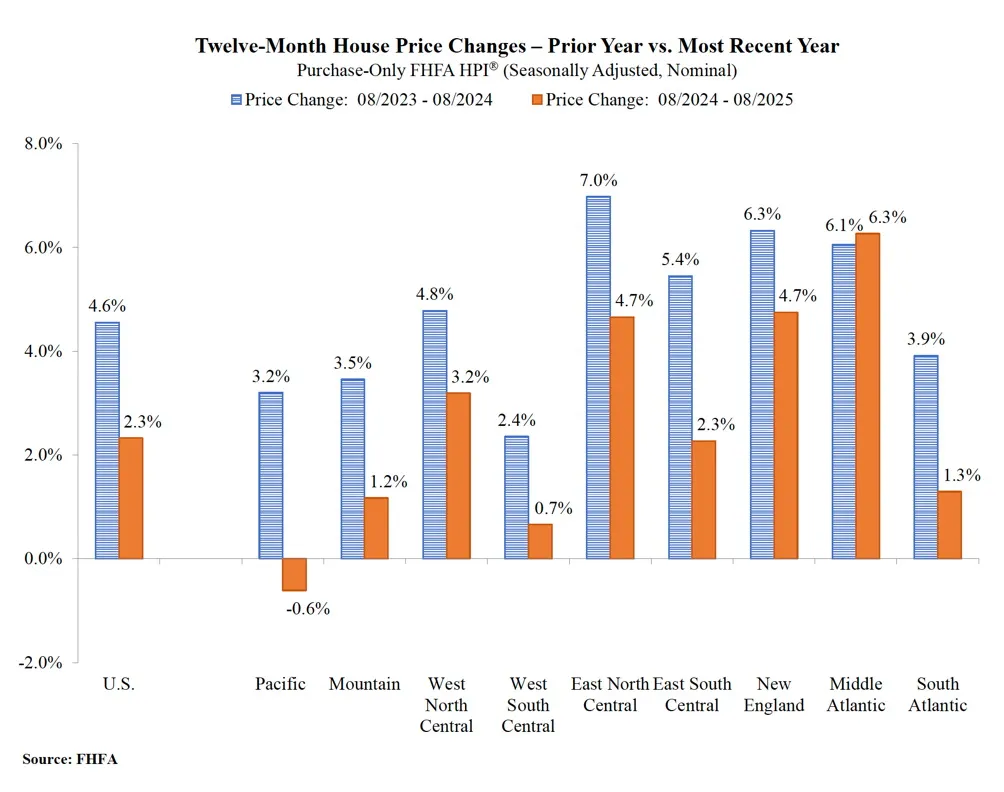

FHFA Says Home Prices Up 2.3% Year-Over-Year in August

According to the latest Federal Housing Finance Agency’s (FHFA) House Price Index (HPI), home prices U.S. house prices house prices rose 0.4% in August, 2025. In addition, year-over-year, house prices have rose 2.3% from August 2024 to August 2025. The FHFA HPI is the nation’s only collection of public, freely available house price indexes that measure changes in single-family home values based on data from all 50 states and over 400 American cities that extend back to the mid-1970s.

Market Trends

November 4, 2025

S&P Cotality Case-Shiller Says Home Prices are Slowing

The latest S&P Cotality Case-Shiller U.S. National Home Price NSA Index has reported a 1.5% annual increase for August, 2025. Their 10-City Composite posted 1.8% increase year-over-year and their 20-City Composite posted a 2.3% year-over-year increase. They say U.S. home prices are continuing to slow.

Market Trends

November 3, 2025

Pending Home Sales Down 0.9% Year-Over-Year

The National Association of Realtors is reporting that pending home sales saw no change in September, 2025 but were down 0.9% year over year. The NAR’s Pending Home Sales Index (a forward-looking indicator based on contract signings) came in at 74.8 in September. The Realtors say that inventory has risen to a 5-year high, which is something that has been consternation for some time.

Market Trends

October 30, 2025

Who’s Buying America’s Homes?

A recent article by Realtor.com says landlords with 1 to 50 properties control 95% of all investor inventory, confirming that rental housing remains largely an entrepreneurial activity rather than a corporate one. They say even in states with the highest rates of investor ownership, it’s not institutional buyers driving the trend. In addition, they say over 90% of investor-owned homes in the U.S. belong to small landlords with fewer than 11 properties.

Market Trends

October 27, 2025

Existing Home Sales Up 1.5% in September

The National Association of Realtors is reporting that existing home sales were up 1.5% in September, 2025 to a seasonally-adjusted annual rate of 4.06 million. Total housing inventory at the end of September was 1.55 million units, down 1.3% from August but up 14% from one year ago. Unsold inventory sits at a 4.6-month supply at the current sales rate with properties remaining on the market for around 33 days. The median existing-home price for all housing types in September was $415,200 – the 27th consecutive month of year-over-year price increases.

Market Trends

October 22, 2025

Which States Tax Income and How

The Tax Foundation says that In the first century of state income taxation, only four states transitioned from a graduated-rate to a single-rate, or flat, individual income tax structure. However, the past four years have brought significant focus on income tax reform and relief, and with that, something of a flat tax revolution. Their recent report talks about this transition as well as showing which states tax income and if they do, how.using market is showing strength and where the risks remain.

Market Trends

October 22, 2025

Delinquencies are Inching Up, Affordability is Improving and Refinances are Surging

On a recent episode of Real Estate News for Investors, Kathy Fettke discusses how mortgage delinquencies are inching up, affordability is finally improving and refinance demand is surging as mortgage rates dip back toward 6%. In this episode, Kathy Fettke breaks down the latest ICE Mortgage Monitor Report for October 2025, that reveals where the housing market is showing strength and where the risks remain.

Market Trends

October 20, 2025

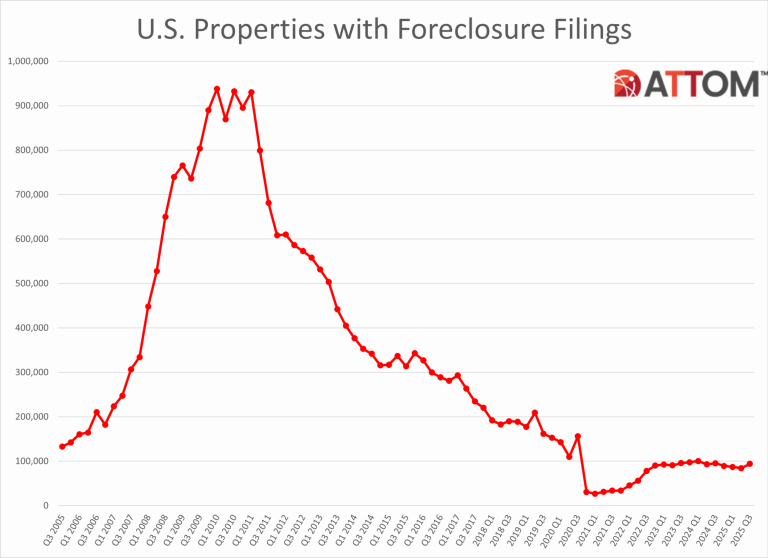

Foreclosure Activity Trending Higher

According to ATTOM Data’s Q3 2025 U.S. Foreclosure Market Report, there were 101,513 residential properties with foreclosure filings (default notices, scheduled auctions or bank repossessions) in the 3rd quarter, up 17% from one year ago. In addition, the report also shows a total of 35,602 properties with foreclosure filings in September 2025, down 0.3% from August and up 20% from one year ago.

Market Trends

October 16, 2025

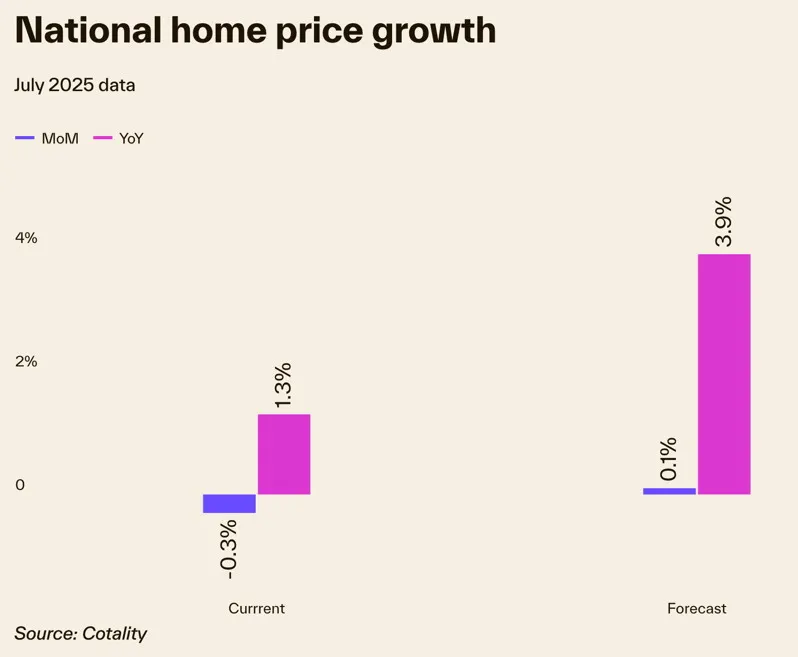

Cotality Home Price Insights – October 2025

According to the latest Cotality (formerly CoreLogic) Home Price Insights (HPI) report, price growth in August rose 1.3%. In addition, they say monthly price increases were in negative territory – down 0.3% between July & August 2025, following a 0.2% decline in July. Interestingly, negative home price growth is mainly concentrated in Florida where seven of the top 10 metros reporting negative growth are located.

Market Trends

October 13, 2025

FHFA Says Home Prices Up 2.3% Year-Over-Year

According to the latest Federal Housing Finance Agency’s (FHFA) House Price Index (HPI), home prices U.S. house prices house prices fell 0.1% in July. However, year-over-year, house prices have risen 2.3% from July 2024 to July 2025. The FHFA HPI is the nation’s only collection of public, freely available house price indexes that measure changes in single-family home values based on data from all 50 states and over 400 American cities that extend back to the mid-1970s.

Market Trends

October 13, 2025

Apartment List’s National Rent Report – October 2025

On a recent episode of the Rent Perfect podcast David Pickron and Scot Aubrey dive deep into one of the most overlooked topics in real estate: setting boundaries with tenants. Whether you’re a seasoned investor or just getting started, this conversation will reframe how you view your rental business—and your tenants.

Market Trends

October 8, 2025

How to Stay in Control as a Landlord

On a recent episode of the Rent Perfect podcast David Pickron and Scot Aubrey dive deep into one of the most overlooked topics in real estate: setting boundaries with tenants. Whether you’re a seasoned investor or just getting started, this conversation will reframe how you view your rental business—and your tenants.

Market Trends

October 7, 2025

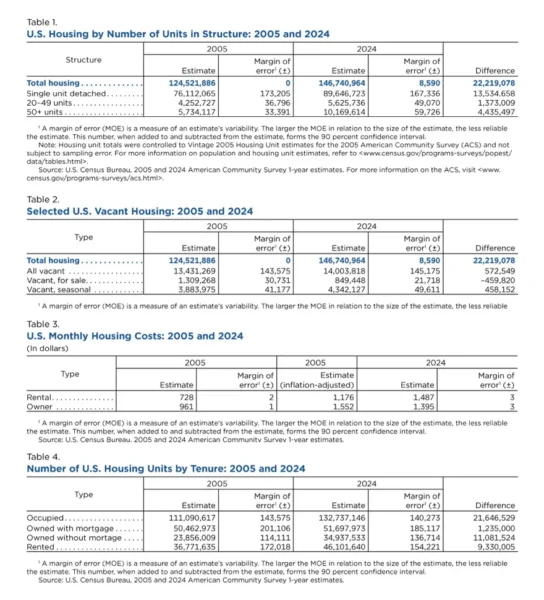

How the Nation’s Housing Changed in 20 Years

How has the Nation’s Housing Changed over the last 20 Years? The Census Bureau says it’s been 20 years since the American Community Survey (ACS) began collecting detailed information on housing in the U.S. – giving us a window into changes that reshaped the nation’s housing over two decades.

Market Trends

October 6, 2025

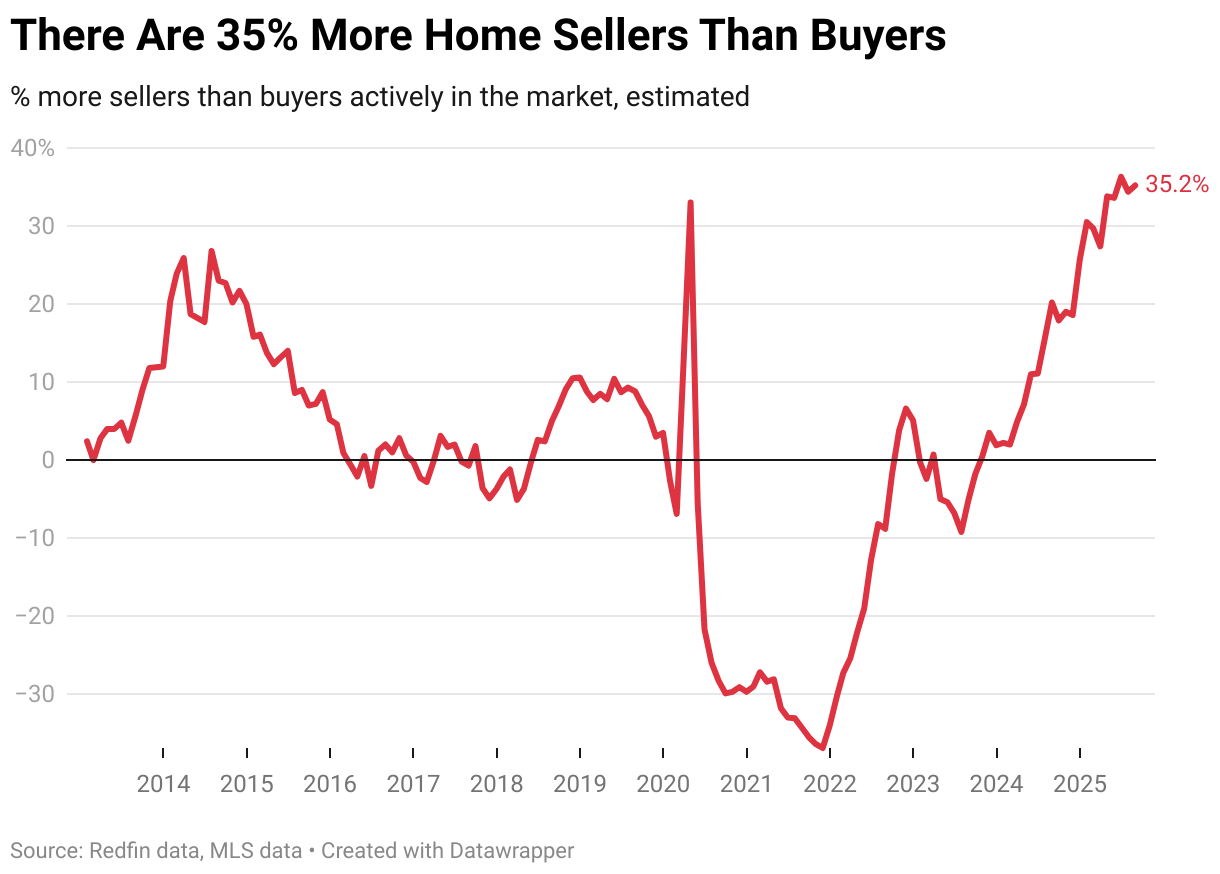

Redfin Says Summer 2025 was the Strongest Buyer’s Market in Over a Decade

Now that Fall is finally here, the numbers are rolling in. Recent MLS data analyzed by Redfin says there were an estimated 35.2% more home sellers than buyers in the U.S. housing market in August. In addition, they say June 2025 was the only month in records dating back 2013 when sellers outnumbered buyers by a greater percentage (36.3%). They say this past summer was the strongest buyer’s market on record.

Market Trends

October 1, 2025

Zumper’s National Rent Report for September ’25

“National rent prices have cooled over the past few months as the rental market continues to recalibrate…A combination of cautious renter demand amid economic headwinds, ample inventory on the market, and a labor market that’s losing momentum have eased the pressure on rents we saw earlier this year.” Said Zumper CEO Anthemos Georgiades.