Finding Shelter: How Hard Money Funds Perform During Market Uncertainty

Why Hard Money Funds Might Be Your Safe Harbor in Today’s Choppy Markets With recent headlines about trade tariffs and […]

The Evolution of Private Debt – From Niche Strategy to Mainstream Asset Class

My Journey into Hard Money Lending The year was 2003. I was a 22-year-old kid trying to learn about real […]

Tax Implications of Directly Owning Oil & Gas Assets

The oil and gas industry provides various ownership opportunities for accredited investors seeking tangible, royalty-generating assets, including working interests, midstream […]

Mineral Rights: A Lucrative Opportunity in Energy and Real Estate

Owning mineral rights can offer lucrative rewards, making it an increasingly attractive option for savvy accredited investors. Mineral rights ownership […]

Factors That Influence the Value of Mineral Rights

Are you wondering how to buy mineral rights that will give you the best value? Trying to predict what the […]

Why Evaluating Oil and Gas Investments Takes Time

Mineral rights can be extremely complex and there are many different risk factors associated with acquiring them. When you have […]

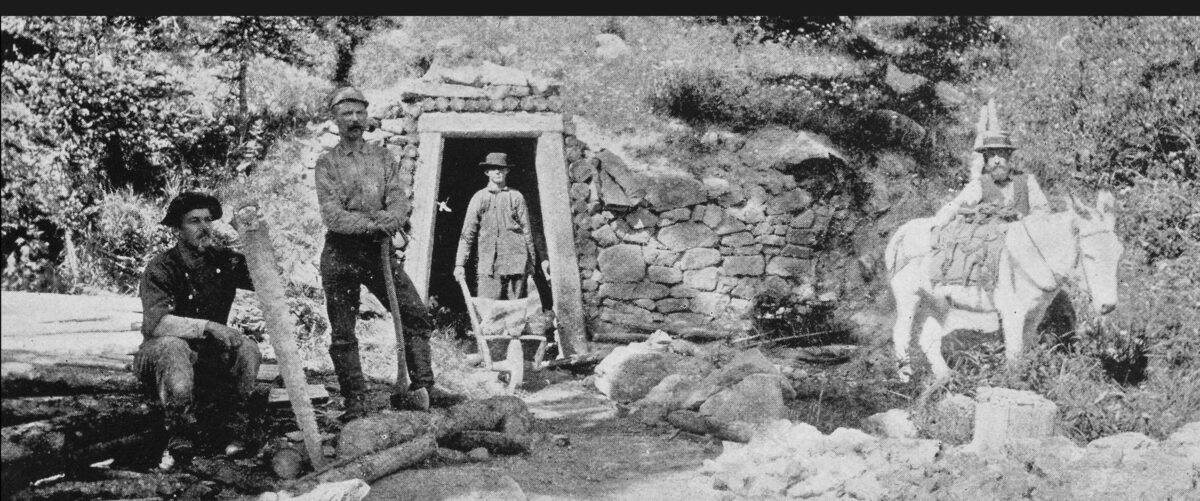

Are Mineral Rights Considered Real Property?

Colorado has a rich history of mining that still plays a big role today. Knowing the ins-and-outs of mineral rights […]

1031 Exchanges for Mineral Rights: Does It Work?

Can a Section 1031 tax exchange be used for mineral rights? Contrary to commonlyheld beliefs, yes— it can be used […]

What people say about colorado RE•CON

“Next-Level Events”

“The meetings are organized, the speakers are incredible, and the value is unreal. Whether you're new or experienced, Colorado RE•CON delivers.”

"Serious Investor Training"

“Colorado RE•CON doesn’t waste time. Every session is actionable and packed with expert-level insight.”

Robert Groll

Denver Metro Investor

Michael W.

Colorado Investor